- Money Explored

- Posts

- 💸 Visa Tests Stablecoin Payouts

💸 Visa Tests Stablecoin Payouts

Fintech’s eating the world—don’t get left behind in 2025! If you haven’t already, check out our FREE Spot The Next Big Fintech Guide

Hey Fintech Explorers—Welcome back to Money Explored, the essential Sunday newsletter to stay ahead in fintech!

This week, a payments giant makes its boldest stablecoin move yet, a U.S. super-app quietly drops an AI finance companion, and a consumer-tech titan decides it’s time to take on Apple in credit.

You’ll also want to keep reading for this week’s sponsor, Superhuman AI, the daily shortcut used by over 1M professionals to get sharper on AI in just 3 minutes.

Here’s what we’re diving into:

Visa tests stablecoin payouts for creators worldwide. 💸

Cash App rolls out Moneybot, its new AI-powered finance assistant. 🤖

Samsung teams with Barclays to challenge Apple in credit. 💳

Plus: An exchange expands in Southeast Asia, a B2B marketplace goes all-in on AI, and a major partnership aims to connect millions more to inclusive digital finance.

It’s all happening—and that’s just the start…

First time reading? Sign up here to join 10,000+ readers staying ahead in fintech every Sunday.

Let’s dive in!

🌎 3 Major Stories

Dive into this week’s top Fintech developments.

Visa Unleashes Stablecoins for Creator Payments 💸

Picture Credit: Unsplash

The Big Story 📰: Visa is reshaping the future of payments for creators, freelancers, and on-demand workers by leveraging stablecoins and AI. As traditional cross-border payment systems falter under the demands of a global workforce, Visa is testing a feature that allows users to receive payments in dollar-backed stablecoins directly into digital wallets. With millions of creators working in markets with unstable fiat currencies, the ability to receive instant payments could revolutionize how they operate. Visa's Mark Nelsen emphasizes that stablecoins not only provide immediate payment solutions but can also work alongside traditional banking systems, setting the stage for broader adoption and integration.

Key Takeaway ⚡️: Visa's move towards stablecoins is crucial for addressing the glaring inefficiencies in current payment systems, particularly for the creator economy. By enabling faster, direct payments, Visa is not just meeting current demands but is also paving the way for a more inclusive financial landscape, especially in emerging markets. As banks watch this shift, they may need to adapt or risk falling behind. For creators and fintech enthusiasts, this represents a significant step towards more innovative payment solutions that could enhance cash flow management and cross-border transactions. The future of commerce is being redefined, and those in the fintech sector should be prepared to navigate this evolving landscape.

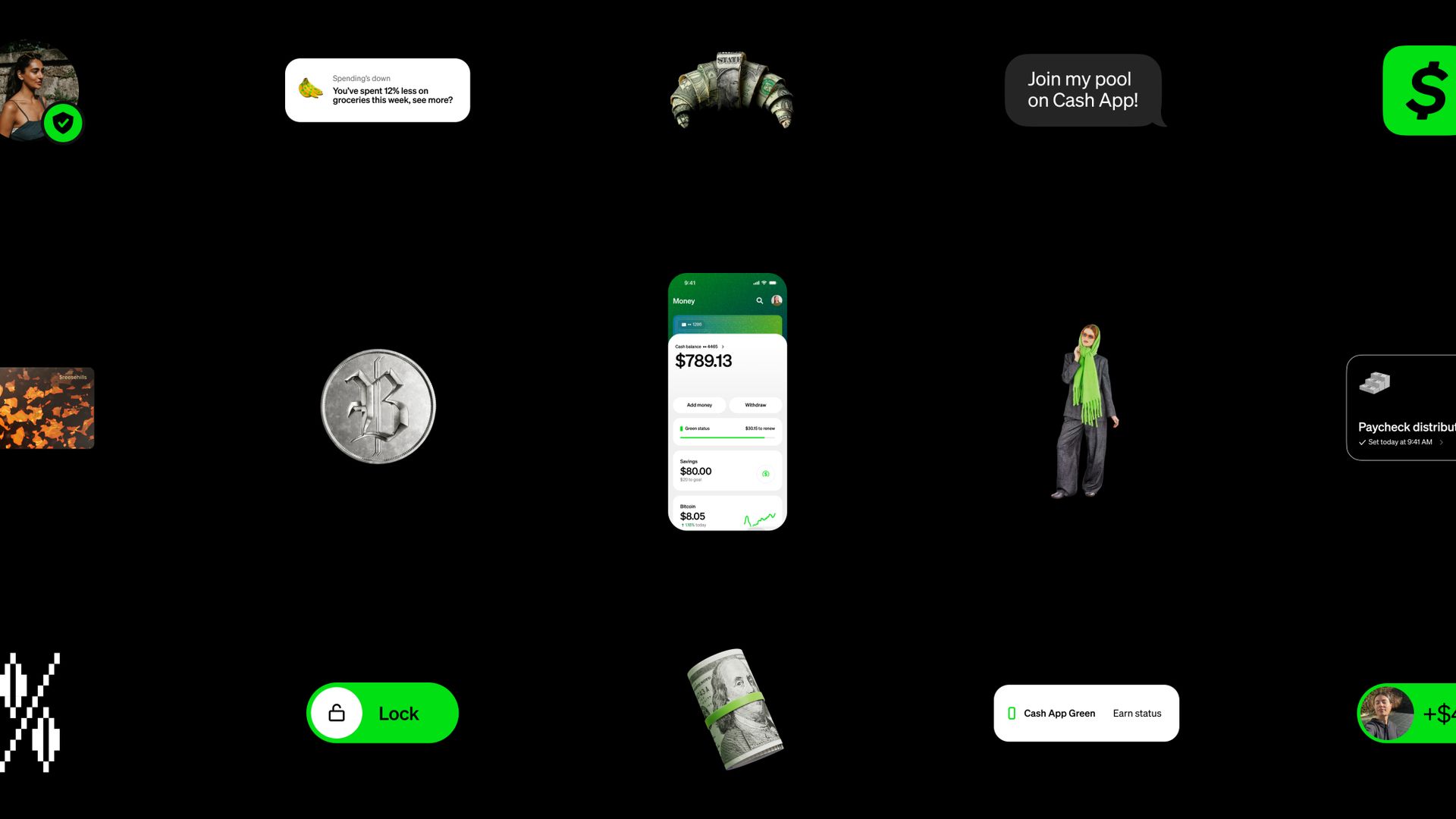

Cash App's New Moneybot: Your Finance Buddy 🤖

Picture Credit: Cash App

The Big Story 📰: Cash App is rolling out a suite of new features, including an AI chatbot named Moneybot that provides personalized financial insights to users. Moneybot can assist in tracking spending patterns, income, and savings, offering actionable suggestions like bill-splitting and transaction summaries. Initially available to select users, the rollout will expand in the coming months. Additionally, Cash App is introducing a new benefits program called Cash App Green, aimed at incentivizing users who engage more with the platform. This update also includes enhanced capabilities for Bitcoin transactions, enabling users to find locations that accept Bitcoin and make payments in USD without holding the cryptocurrency.

Key Takeaway ⚡️: The launch of Moneybot is a significant move for Cash App, as it leverages AI to provide users with tailored financial advice, enhancing user engagement and satisfaction. By allowing consumers to take actionable steps based on their financial data, Cash App fosters better money management, which is crucial in today's economy. The new Cash App Green program further underscores the company's shift toward rewarding frequent users, potentially attracting a larger customer base. As Cash App integrates more features related to Bitcoin and stablecoins, it positions itself well in the competitive fintech landscape, appealing to a growing segment of cryptocurrency enthusiasts and everyday consumers alike.

Samsung and Barclays Unveil Credit Card to Rival Apple 💳

Picture Credit: PYMNTS

The Big Story 📰: Samsung Electronics is gearing up to challenge Apple’s dominance in the credit card space with the launch of its own credit card in the U.S. The South Korean tech giant is in advanced negotiations with British bank Barclays to create an integrated consumer finance experience within its Galaxy devices and digital wallet services. This anticipated credit card, set to operate on the Visa network, will offer cash-back rewards that can be transferred to a Samsung savings account and used for future product discounts. This venture, which follows a failed credit card attempt in 2018, aligns with Barclays' goal of expanding its U.S. credit card presence.

Key Takeaway ⚡️: Samsung’s entry into the credit card market signifies a bold move to bolster its digital wallet capabilities and enhance customer loyalty. By linking cash-back rewards directly to Samsung products, the company aims to drive usage among the 75 million Galaxy device owners in the U.S. As Samsung also explores additional financial services, including high-yield savings options and buy now, pay later plans, this initiative could redefine competition in the fintech landscape. The stakes are high as both Samsung and Apple evolve their offerings, and fintech enthusiasts should closely monitor these developments, as they promise to shake up user choices and loyalty in the consumer finance space.

A Message From Superhuman AI

Become the go-to AI expert in 30 days

AI keeps coming up at work, but you still don't get it?

That's exactly why 1M+ professionals working at Google, Meta, and OpenAI read Superhuman AI daily.

Here's what you get:

Daily AI news that matters for your career - Filtered from 1000s of sources so you know what affects your industry.

Step-by-step tutorials you can use immediately - Real prompts and workflows that solve actual business problems.

New AI tools tested and reviewed - We try everything to deliver tools that drive real results.

All in just 3 minutes a day